Quick Points: Earn more points and miles with Uber, Lyft and Starbucks apps

Editor's Note

Credit cards (and their welcome bonuses) are at the top of our list of easy ways to earn points and miles. Beyond that, we hope you're shopping through an online shopping portal like Rakuten to earn even more cash back or rewards on your online purchases.

But you may have overlooked one of the simplest ways to earn points and miles: linking a rewards program in some of your favorite apps. If so, now is the time to grab your phone and make sure you've connected your accounts to earn rewards for multiple programs when you make a coffee run or call a ride-hailing service.

Link your Delta SkyMiles and Starbucks accounts

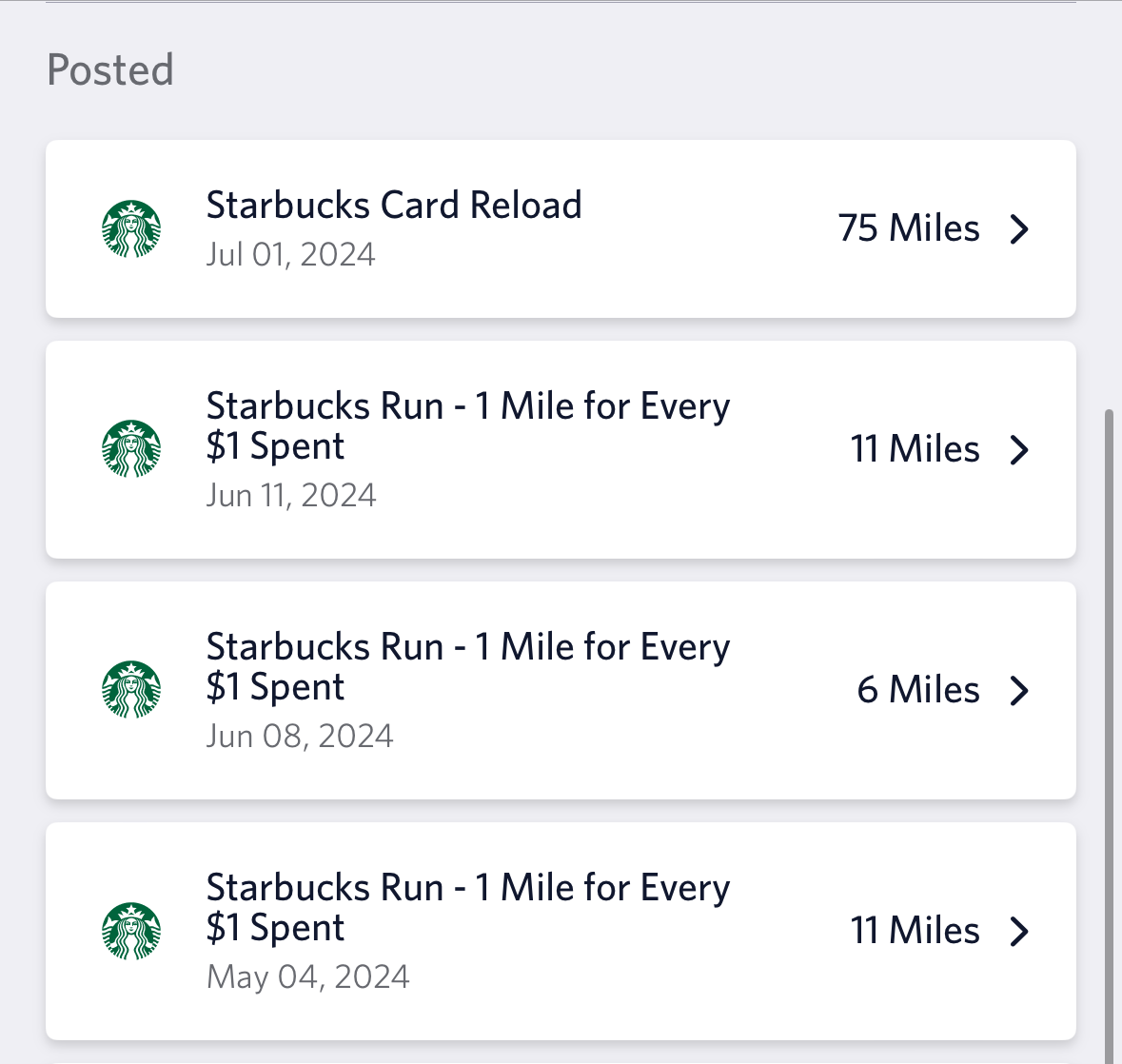

Delta Air Lines and Starbucks' partnership allows customers to link their rewards accounts to earn Delta SkyMiles alongside Starbucks Stars, and double Starbucks Stars on days when flying with Delta.

Previously, you could earn miles for every dollar spent at Starbucks, but this changed in 2024. Now, you'll only earn miles when you reload at least $25 into your Starbucks app.

The number of miles you'll earn depends on the amount you reload, but you can earn as many as 2 miles per dollar when your accounts are linked.

Don't expect a free flight from a coffee order, but this is an easy way to squeeze even more rewards from your coffee habit.

And, of course, be sure to use a card that offers a nice bonus on dining purchases.

Related: The best credit cards to use at Starbucks

Earn points and miles with Lyft

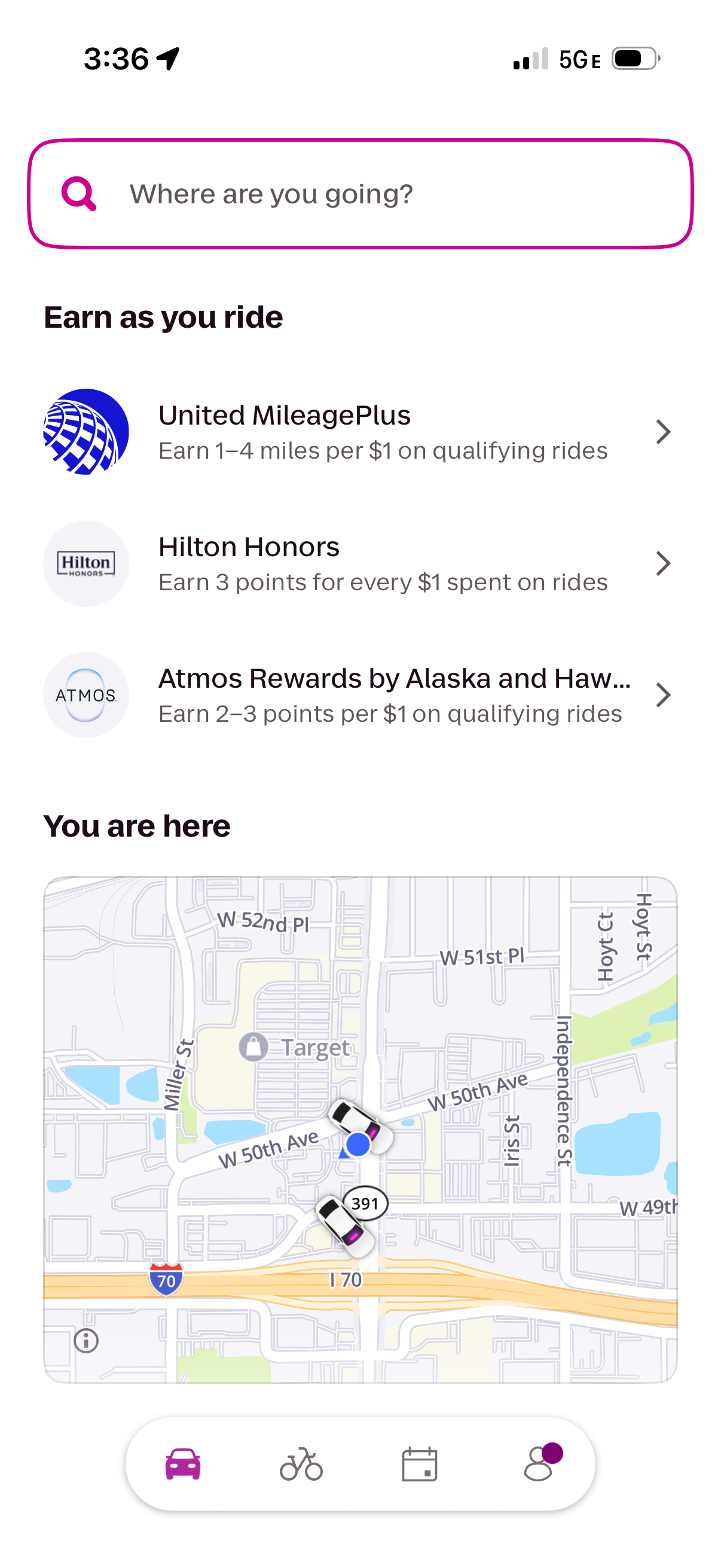

On your Lyft app, you may think you're already maximizing your earning potential by setting an eligible Chase card as your automatic payment method. But if you haven't chosen a travel rewards program to link, you're leaving rewards on the table.

On your app home screen, under "Earn as you ride," you can connect your United MileagePlus, Hilton Honors, Alaska Airlines Atmos Rewards or Bilt Rewards account.

Note that different types of rides earn different reward amounts on your linked account, so be sure to check out Lyft's description of each program's earning potential before deciding which one to link.

Pro tip: Consider Bilt. This is often the most valuable partner since you can earn 2 Bilt Rewards Points for every dollar spent and transfer them to various partners (including Hyatt) at a 1:1 ratio.

Related: New Bilt 2.0 cards have arrived: How you can earn points on rent, mortgages and more

Earn points and miles with Uber

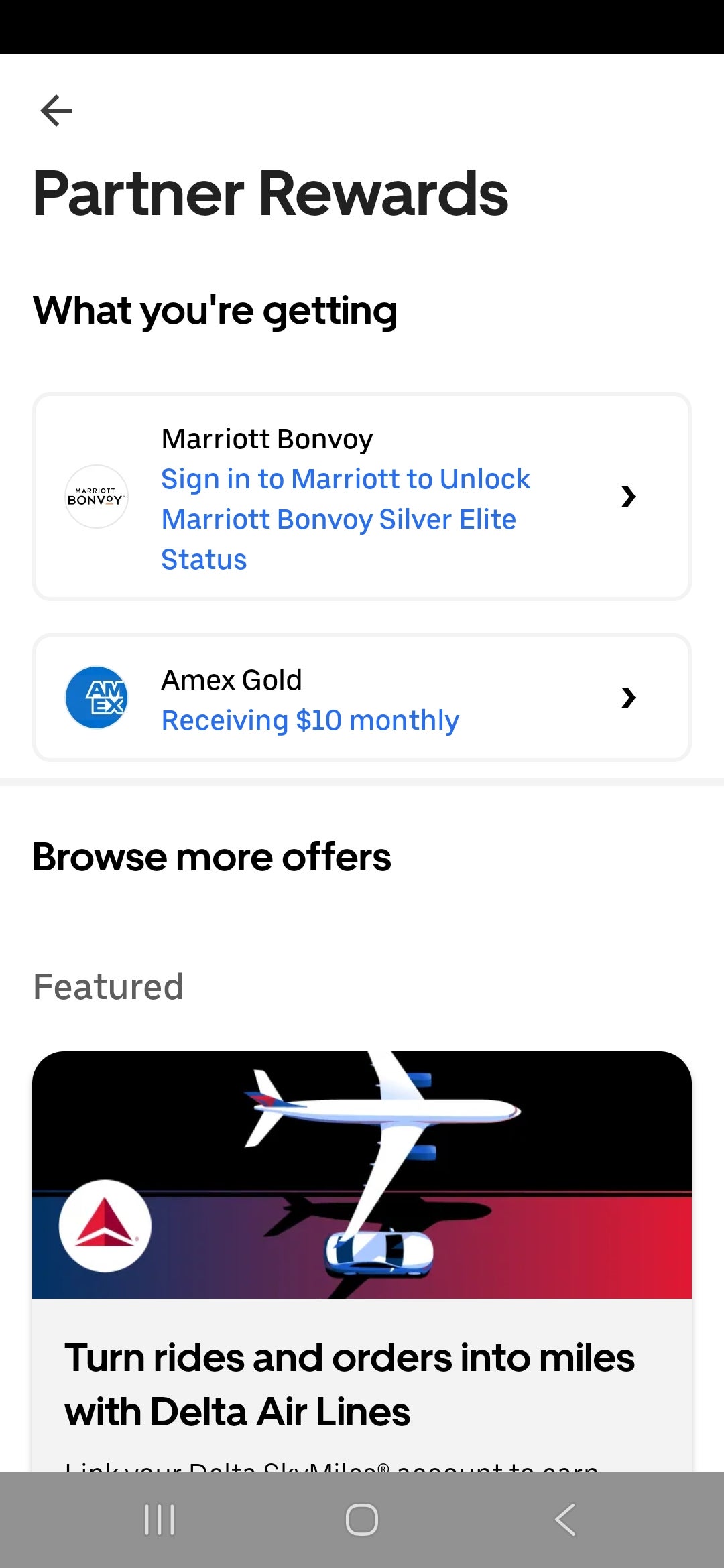

In addition to taking advantage of your American Express Uber credits, you have two other ways to maximize Uber purchases. You can link either your Marriott Bonvoy or Delta SkyMiles account to earn Marriott points or Delta miles on your Uber rides and Uber Eats orders.

From your Uber profile, select "Partner Rewards."

You'll see your Uber credits from any Amex cards you have at the top. Then, scroll down to connect your Marriott or Delta account. Each program has a different earning structure, so review Uber's guidelines for Delta and Marriott and consider which type of reward is more valuable to you before making your selection. (You can always change it later.)

Once your accounts are connected, you'll start earning points or miles on qualifying Uber transactions, including rides and food delivery.

For both Uber and Lyft, consider adding a card that offers a bonus on travel purchases. One particularly great option is the Chase Sapphire Preferred® Card (see rates and fees), which offers a welcome bonus of 75,000 Chase Ultimate Rewards points after you spend $5,000 on purchases on your new card in the first three months from account opening. With it, you'll earn 2 points per dollar spent on travel — including ride-hailing services — on top of your linked account earnings.

Related: Frequent Uber or Lyft user? These are the best credit cards for you

Bottom line

Ensure you're taking advantage of opportunities to double-dip rewards, including by linking partner programs through the apps you use regularly when you spend. And while you're at it, become the friend who volunteers to make the Starbucks run or order the Uber or Lyft. Bonus rewards await.

TPG featured card

at Bilt's secure site

Terms & restrictions apply. See rates & fees.

| 1X | Earn up to 1X points on rent and mortgage payments with no transaction fee |

| 2X | Earn 2X points + 4% back in Bilt Cash on everyday purchases |

Pros

- Unlimited up to 1 Bilt Point per dollar spent on rent and mortgage payments

- Elevated everyday earnings with both Bilt Points and Bilt Cash

- $400 Bilt Travel Portal hotel credit per year (up to $200 biannually)

- $200 Bilt Cash annually

- Priority Pass membership

- No foreign transaction fees

Cons

- Moderate annual fee

- Housing payments may include transaction fees, depending on the payment method

- Designed primarily for members seeking a premium, all-in-one card

- Earn points on housing with no transaction fee

- Choose to earn 4% back in Bilt Cash on everyday spend. Use Bilt Cash to unlock point earnings on rent and mortgage payments with no transaction fee, up to 1X.

- 2X points on everyday spend

- $400 Bilt Travel Hotel credit. Applied twice a year, as $200 statement credits, for qualifying Bilt Travel Portal hotel bookings.

- $200 Bilt Cash (awarded annually). At the end of each calendar year, any Bilt Cash balance over $100 will expire.

- Welcome bonus (subject to approval): 50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash.

- Priority Pass ($469/year value). See Guide to Benefits.

- Bilt Point redemptions include airlines, hotels, future rent and mortgage payments, Lyft rides, statement credits, student loan balances, a down payment on a home, and more.